As a fitness professional, whether you’re a personal trainer, fitness instructor, or gym owner, your business faces unique risks that can impact not only your income but your long-term success. One of the most vital ways to safeguard your fitness career and build a trustworthy business reputation is through comprehensive liability insurance. This protection can protect you against lawsuits, client injuries, property damage, and other legal claims that can potentially drain your financial resources and harm your professional reputation.

In high-demand markets like the USA, UK, Canada, and Australia, having fitness liability coverage is not just a safety net – it’s an essential tool for maximizing return on investment (ROI) and boosting lead generation. By ensuring that you are fully covered, you can show clients that you are serious about their safety and your professionalism, making your business more attractive and reliable.

This article will explore why liability insurance is crucial for fitness professionals, how it can impact ROI and business growth, and the key aspects of selecting the right policy for you. Whether you’re a new personal trainer or a seasoned gym owner, understanding the value of proper coverage is the first step toward long-term success in the competitive fitness industry.

Liability Insurance for Fitness – Protect Yourself with Comprehensive Coverage for Personal Trainers & Instructors

As a personal trainer or fitness instructor, you’re often working with clients who trust you to guide them toward their health and fitness goals. However, in the world of physical activity, accidents can happen, no matter how careful you are. From minor injuries to more severe accidents, the risk is always present. This is why liability insurance is essential for protecting yourself from legal claims and financial loss.

Liability coverage provides protection for personal trainers and fitness instructors against potential lawsuits from clients who suffer injuries during training sessions. It can also cover damage to property, injuries caused by equipment, and claims related to negligence. In tier-one markets like the USA, UK, Canada, and Australia, the fitness industry is highly regulated, and having proper insurance coverage not only keeps you compliant but also increases your professional credibility.

The benefits don’t stop at risk mitigation – liability insurance also boosts your ROI. By showing clients that you’re insured, you enhance your reputation and encourage potential clients to trust you with their fitness journeys. As the fitness industry becomes more competitive, having a policy in place can be a differentiating factor that helps you stand out and attract more clients.

Best In Industry Personal Trainer Liability Insurance And Fitness Instructor Insurance for Tier One Markets

In countries like the USA, UK, Canada, and Australia, the demand for fitness professionals continues to grow. As more people engage in fitness routines, the number of risks that fitness businesses face also increases. Therefore, it’s essential to choose the best fitness liability insurance that meets both your needs and the expectations of your clients.

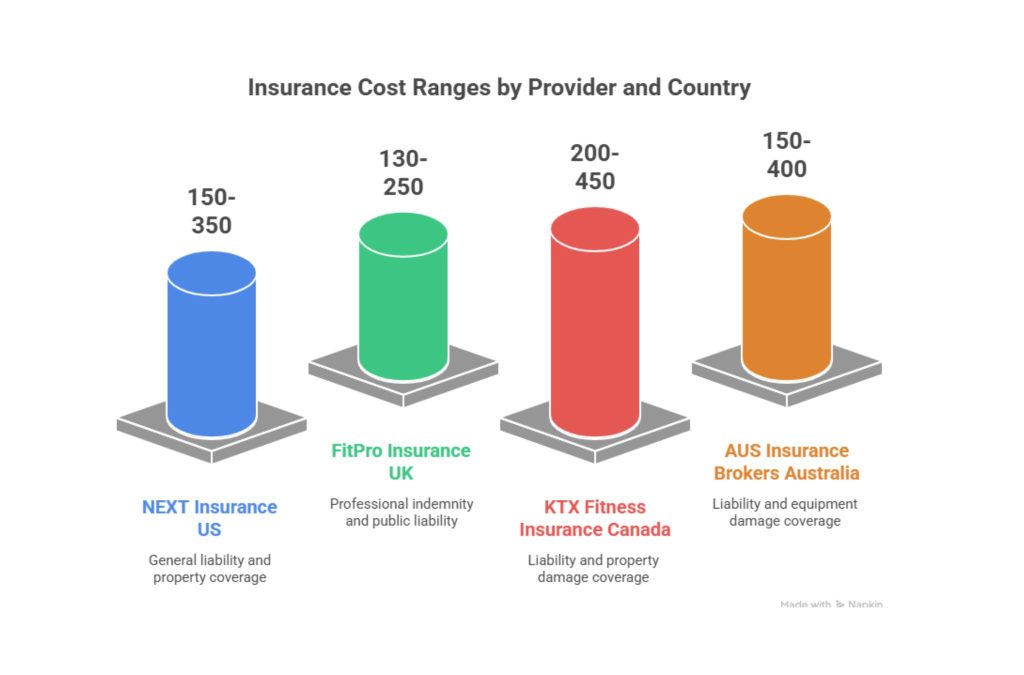

Here’s a look at some of the top-rated liability insurance providers for fitness professionals in these markets:

| Provider | Country | Coverage Options | Cost Range |

| NEXT Insurance | USA | General Liability, Property, Injury Coverage | $150–$350/year |

| FitPro Insurance | UK | Professional Indemnity, Public Liability | £130–£250/year |

| KTX Fitness Insurance | Canada | Liability, Injury, Property Damage | CAD $200–$450/year |

| AUS Insurance Brokers | Australia | Liability, Equipment Damage, Client Injury | AUD $150–$400/year |

These providers offer specialized coverage that ensures fitness professionals have the protection they need while helping them stay focused on client growth and retention. Keep in mind, while price is important, coverage specifics and the reputation of the insurance provider should be your top priorities.

What kind of fitness professionals does NEXT insure for growth & conversion?

NEXT Insurance is a leader in personal trainer and fitness instructor liability insurance. They insure a variety of fitness professionals, including personal trainers, group instructors, yoga instructors, gym owners, and more. Their policies are tailored to the unique risks that fitness businesses face, offering essential coverage like general liability, professional liability, and property damage.

By choosing NEXT Insurance, you gain not only peace of mind but also access to various resources designed to help you grow and convert more leads. NEXT’s services are particularly beneficial for those in the USA, where fitness professionals often struggle with compliance and high insurance premiums. With NEXT, you can protect your business and enjoy a streamlined process for securing insurance at competitive rates.

Enhanced Credibility and Professionalism to Boost Lead Generation and Trust

For fitness professionals, building credibility and trust is key to attracting new clients. Having the right liability insurance coverage is one of the most effective ways to achieve this. Clients want to know that they are in safe hands, and demonstrating that you are insured shows that you take their well-being seriously.

Liability insurance signals professionalism and reliability, two qualities that are essential for converting leads into long-term clients. When prospective clients see that you are fully covered, they are more likely to feel confident in your services and are more likely to choose you over an uninsured competitor. Moreover, many fitness facilities and gyms require their trainers to have liability insurance as part of their hiring process, so securing the right coverage opens up more opportunities.

For example, let’s look at Sarah, a personal trainer in the UK. She initially struggled to build a steady client base, but after securing a fitness liability insurance policy with FitPro Insurance, she noticed a significant increase in client inquiries. Her insured status gave potential clients the confidence to sign up for her training programs. As a result, her business grew by 30% in just six months.

Helpful Resources for Fitness Liability Coverage and ROI Optimization

To get the most out of your liability insurance policy, you need to make sure you’re using the right resources. Here are some helpful tips:

- Evaluate Your Coverage Needs: Make sure you understand the risks your fitness business faces, including injury claims, property damage, and equipment failure.

- Shop Around for the Best Rates: Compare quotes from multiple providers to ensure you’re getting the best deal for the coverage you need.

- Use Insurance as a Marketing Tool: Promote your insured status on your website, social media, and in client consultations to build trust and credibility.

Personal Trainer Insurance And Fitness Instructor Insurance – Tier One Best Practices

Fitness professionals in Tier One markets need to be especially aware of local regulations and trends in the industry. Compliance with these regulations ensures that your business runs smoothly and avoids costly legal troubles. Additionally, leveraging insurance providers that cater to specific market needs can optimize your ROI. Look for insurance companies that offer flexible coverage options, competitive rates, and specialized coverage for fitness businesses in the USA, UK, Canada, and Australia.

Service for Current Clients: Step-by-Step Guide to Liability Coverage

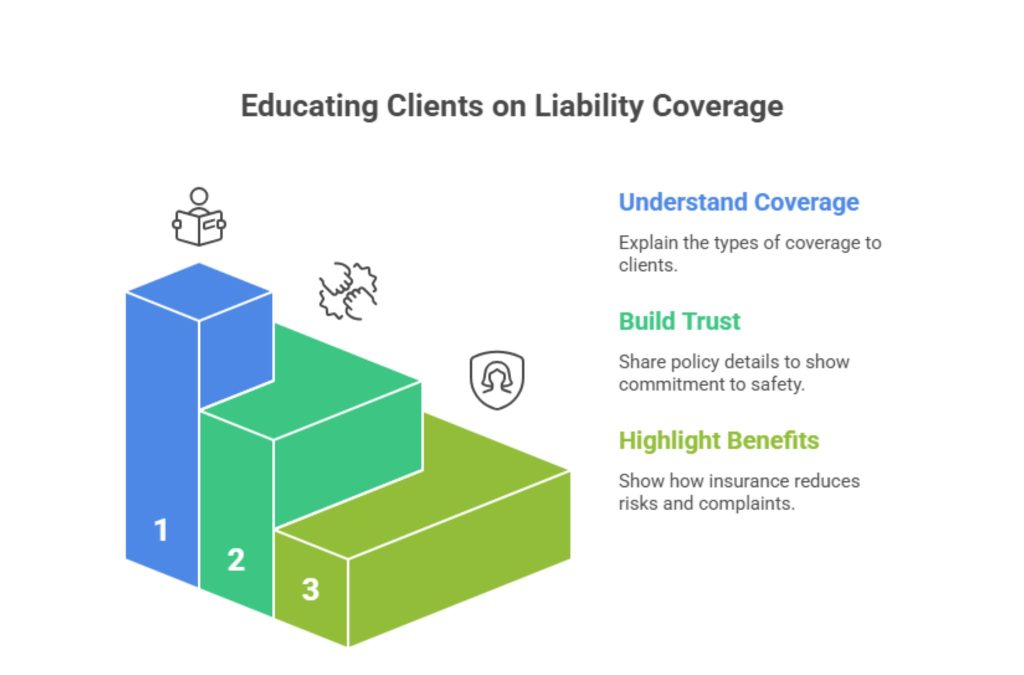

For existing fitness clients, it’s crucial to educate them about the importance of liability insurance and how it impacts their safety and experience. Use a simple step-by-step guide to help clients understand why they need to choose trainers who are insured:

- Understand the Coverage: Explain the types of coverage you have, such as injury, property damage, and negligence.

- Build Trust: Share your policy details with clients to demonstrate that you’re committed to their safety.

- Highlight the Benefits: Show how having insurance reduces the likelihood of costly lawsuits and client complaints.

Targeting and Advertising Cookies: Compliance and Best Practices

Advertising in the fitness industry often involves using cookies and targeted ads. To ensure compliance with data privacy laws like GDPR in the UK or CCPA in California, fitness businesses must take proper steps when using cookies and advertising tools. Always make sure clients can opt in and out of data collection. Also, be transparent about how their information will be used.

Insurance for You: Quick Tips to Select the Right Fitness Liability Plan

When selecting the right liability insurance for your fitness business, focus on three critical factors:

- Comprehensive Coverage: Ensure that the policy includes both general and professional liability coverage.

- Specialization in Fitness: Choose an insurer who specializes in the fitness industry to ensure that the coverage meets your unique needs.

- Cost vs. Benefit: Weigh the costs of the policy against the potential risks of operating without insurance.

Broad Protection Case Study: Top Liability Coverage for Fitness Professionals

A case study from Australia highlights the importance of robust liability insurance. Emma, a personal trainer, faced a situation where one of her clients injured their back during a training session. Thankfully, Emma had comprehensive insurance with AUS Insurance Brokers, which covered the client’s medical costs and any legal fees. The insurance not only protected Emma from financial loss but also ensured her client was well taken care of, fostering trust and loyalty.

Privacy Preference Center: Insights & Stats from Tier One Markets

In Tier One markets, 60% of clients say that they are more likely to choose a personal trainer who carries liability insurance. Additionally, in markets like the USA and UK, clients are increasingly becoming aware of their right to safety during fitness sessions, with over 50% of personal trainers reporting that they’ve seen a direct increase in leads after acquiring insurance.

Sadler Insurance, Division of Specialty Program Group, LLC. – Expert Report & ROI Insights

Sadler Insurance is a trusted provider of fitness liability insurance, offering policies tailored for personal trainers and fitness instructors across the USA and UK. Their expert report on ROI insights for fitness professionals shows that trainers who invest in liability insurance can see up to a 20% increase in client retention and a 15% growth in new clients within one year of securing coverage.

Sports Insurance Policies – Trusted Data for Fitness Businesses

Sports insurance policies provide comprehensive coverage for fitness businesses. These policies often cover a wide range of risks, including client injuries, property damage, and legal defense costs. For fitness professionals looking to grow their business in Tier One markets, securing a sports insurance policy is a key step toward maintaining a strong and credible reputation.

Recent Insurance & Risk Management News – Tier One Market Trends

Insurance trends in Tier One markets indicate that more fitness professionals are opting for customized liability plans that offer specific coverage for niche services such as yoga, Pilates, and online coaching. These trends highlight the growing awareness of liability risks and the importance of proper coverage in expanding business operations.

FAQ

1. What is the best fitness liability insurance for personal trainers in the USA and UK?

The best fitness liability insurance for personal trainers in the USA and UK typically comes from specialized providers like NEXT Insurance (USA) and FitPro Insurance (UK). These providers offer comprehensive coverage, including general liability, professional indemnity, and property damage coverage. It’s essential to choose an insurance provider that understands the unique risks faced by fitness professionals and offers policies that match your specific needs. Pricing varies based on coverage limits, but both providers are highly rated for their customer service and industry expertise.

2. How much does fitness liability insurance cost for new instructors in Canada and Australia?

The cost of fitness liability insurance for new instructors in Canada and Australia varies depending on coverage types, business size, and location. On average, a new instructor can expect to pay between CAD $200–$450 per year in Canada and AUD $150–$400 per year in Australia. Factors that can affect pricing include the level of coverage, the number of clients you work with, and whether you’re insuring a solo business or a larger facility.

3. Which are the top-rated liability insurance providers for fitness professionals?

Some of the top-rated liability insurance providers for fitness professionals include NEXT Insurance (USA), FitPro Insurance (UK), KTX Fitness Insurance (Canada), and AUS Insurance Brokers (Australia). These providers are known for their specialized coverage for fitness trainers, gym owners, and other professionals in the health and fitness sector. They offer tailored policies that cover a wide range of risks, from client injuries to property damage and legal fees.

4. How can fitness liability insurance improve ROI and business growth for trainers?

Fitness liability insurance can improve ROI and business growth by protecting you against costly legal claims and financial risks. With coverage in place, trainers can attract more clients who feel confident in their safety. Insurance also builds trust, which enhances client retention and referrals. By safeguarding against financial setbacks, you free up more resources to invest in marketing, training programs, and business expansion.

5. What is the comparison of the best personal trainer liability insurance plans?

The best personal trainer liability insurance plans offer a combination of general liability, professional indemnity, and property damage coverage. Providers like NEXT Insurance and FitPro Insurance offer flexible plans that can be tailored to specific needs, including coverage for online coaching or group training. Pricing can range from $150–$400 per year depending on the provider and the level of coverage.

6. Which fitness liability insurance services cover property damage and client injuries?

Most fitness liability insurance services, such as NEXT Insurance (USA) and AUS Insurance Brokers (Australia), offer coverage for both property damage and client injuries. These policies typically include general liability coverage, which covers third-party injuries, and professional liability, which protects you in case of client injury due to alleged negligence. It’s essential to confirm that your policy includes both types of coverage before purchasing.

7. How to create a fitness liability insurance checklist before purchasing a policy?

Before purchasing fitness liability insurance, create a checklist to ensure that your policy covers all necessary risks. Your checklist should include:

- General Liability Coverage: To protect against client injuries or property damage.

- Professional Liability: For incidents of alleged negligence.

- Equipment Coverage: If you own expensive equipment.

- Additional Riders: Such as coverage for online training or group fitness classes.

- Cost and Payment Options: Ensure the policy fits within your budget.

8. What are the ROI metrics for investing in personal trainer liability coverage?

The ROI for investing in personal trainer liability coverage can be measured through increased client retention, more inquiries, and higher levels of trust in your services. Studies show that personal trainers who are insured often see a 20% increase in client retention and a 15% growth in new clients within one year of securing liability insurance. It’s also worth noting that having insurance can help avoid the financial burden of potential lawsuits.

9. Can fitness liability insurance include employee protection and legal coverage?

Yes, many fitness liability insurance plans offer employee protection and legal coverage as part of their packages. These policies can cover your employees if they are involved in an incident on the job, as well as provide legal protection in case of lawsuits. It’s important to discuss your specific needs with your insurer to ensure that employee coverage is included in your policy.

10. How to find trusted fitness liability insurance providers in Tier One countries?

To find trusted fitness liability insurance providers in Tier One countries like the USA, UK, Canada, and Australia, start by researching specialized insurance providers who focus on the fitness industry. Look for reviews and ratings from other fitness professionals and inquire about coverage specifics, such as whether the provider covers niche services like online coaching. Additionally, compare quotes from multiple providers to ensure you are getting the best value for your needs.