Fitness Studio Insurance ROI Solutions for Growth, Conversion, and Business Protection in USA, UK, Canada & Australia

Running a fitness studio involves navigating various risks that could disrupt your business operations and erode your profits. Whether you’re operating in the USA, UK, Canada, or Australia, the risks of accidents, injuries, property damage, or lawsuits are ever-present. To ensure the longevity and success of your fitness studio, comprehensive insurance is a non-negotiable investment. Fitness studio insurance not only protects you from unforeseen circumstances but also contributes to your business’s growth by boosting client confidence, reducing costs, and offering peace of mind.

Fitness studio insurance comes in various forms, each designed to mitigate specific risks. General liability insurance, professional liability coverage, property insurance, and equipment insurance all serve as crucial components of a robust risk management strategy. By selecting the right insurance policies, fitness studio owners can optimize their return on investment (ROI) and ensure a sustainable business future. In this guide, we will explore how fitness studios in Tier One markets can leverage insurance for business growth, risk protection, and greater conversion rates.

Fitness Studio and Gym Insurance Designed to Protect Business Owners and Enterprises in Tier One Countries

The Importance of Fitness Studio Insurance for Business Owners.

Fitness studios, gyms, and wellness centers in Tier One markets such as the USA, UK, Canada, and Australia face unique challenges, including increased competition, high operational costs, and the constant risk of litigation. The right insurance policies are crucial for business owners to safeguard their investments and ensure seamless operations.

Understanding the Importance of Fitness Studio Insurance for Business Success

Understanding Fitness Studio Insurance

Benefits of Fitness Studio Insurance

Essential Factors in Choosing Fitness Studio Insurance

Maximizing Your Investment with Fitness Studio Insurance

Why Investing in Fitness Studio Insurance is Essential for Your Business

In these competitive markets, fitness studios must secure policies that cover the full spectrum of risks, from liability claims to property damage. For example, if a client is injured while using gym equipment, a well-structured insurance policy ensures that the fitness studio is protected against legal claims and the associated financial repercussions. Additionally, for studios offering specialized services such as personal training, yoga, or massage therapy, professional liability insurance is crucial for protecting against lawsuits stemming from alleged errors or negligence.

For official insurance guidelines, visit the USA.gov Business Insurance page.

Learn more about fitness industry regulations at CIMSPA (UK)

Explore insurance standards for Canadian businesses via the Government of Canada .

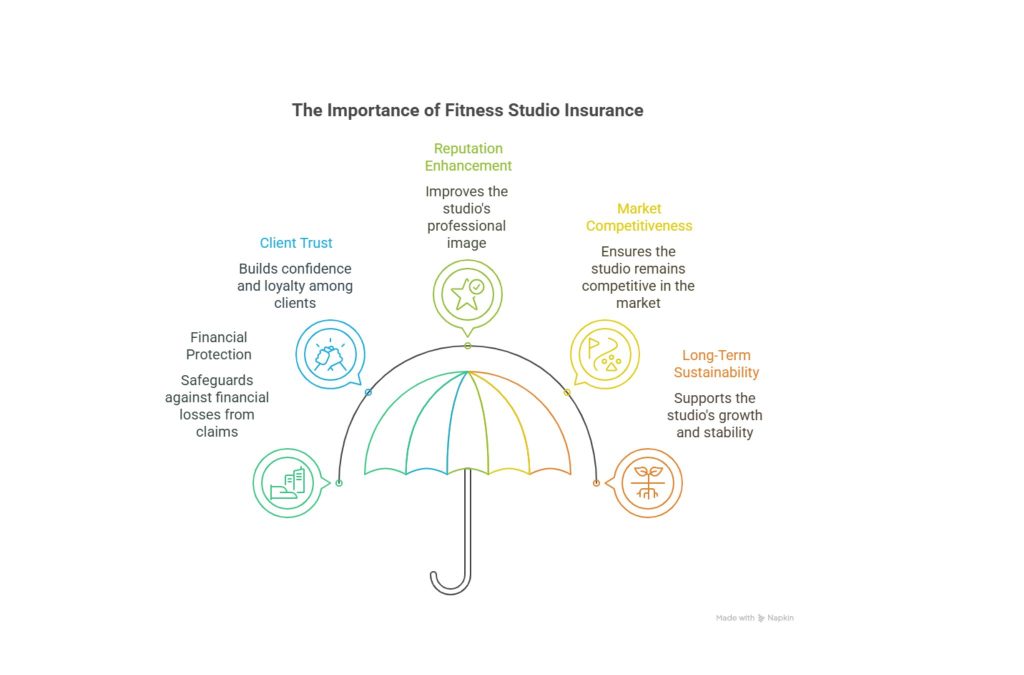

By providing financial protection against these unpredictable events, insurance policies for fitness studios help safeguard the business’s financial stability and long-term viability. This protection allows owners to focus on their business’s growth without the constant worry of unexpected costs arising from accidents or lawsuits.

Key Tip: Invest in a comprehensive fitness studio insurance policy that covers both general liability and professional liability to maximize ROI and minimize risks.

Which Fitness Insurance Policies Do Studios and Gyms Need for Maximum ROI?

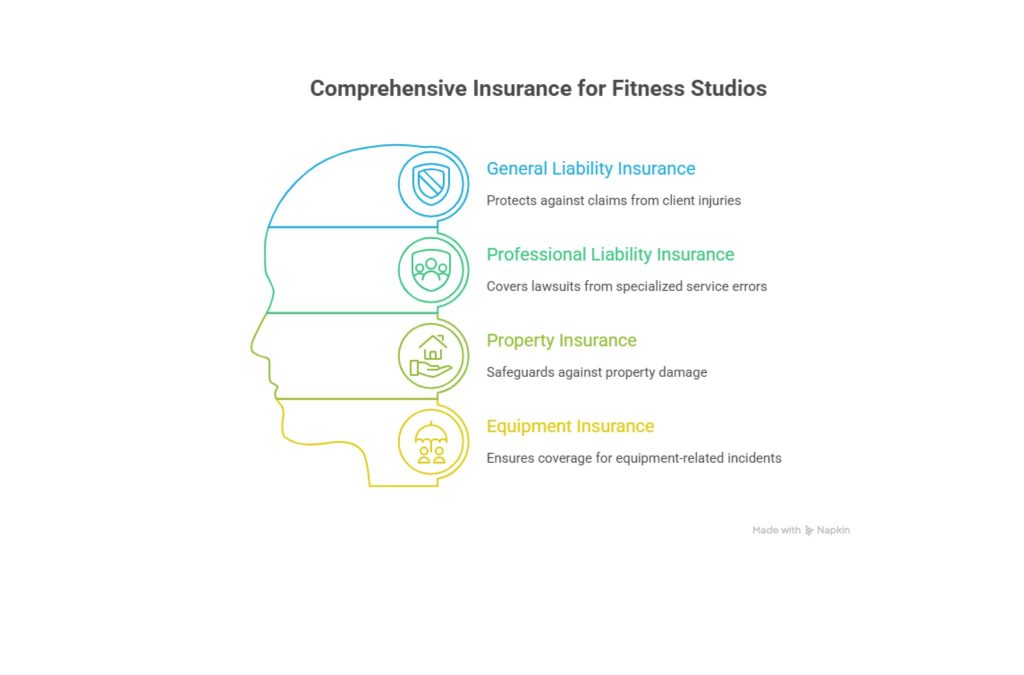

When selecting fitness studio insurance, business owners should consider several types of policies to ensure complete protection. The following policies are essential for maximizing ROI while safeguarding your business:

- General Liability Insurance: This type of coverage protects the studio from claims involving bodily injury, property damage, and advertising injury. For example, if a client slips and falls while on the premises, general liability insurance can cover medical expenses and legal costs.

- Professional Liability Insurance: Also known as errors and omissions insurance, this policy covers lawsuits arising from mistakes or negligence in providing professional services, such as personal training or group fitness instruction.

- Property Insurance: Property insurance protects your fitness studio’s physical assets, including gym equipment, furniture, and other property, against damage or theft.

- Equipment Insurance: Given the high cost of fitness equipment, specialized equipment insurance can cover the repair or replacement of gym machines, treadmills, weights, and other fitness equipment.

- Workers’ Compensation Insurance: In many countries, including the USA, Canada, and Australia, workers’ compensation insurance is required by law. This coverage ensures that employees who are injured on the job receive medical treatment and wage replacement.

A combination of these insurance policies ensures that your fitness studio is protected against a broad range of risks. Moreover, by bundling these insurance types, you can often save money on premiums while ensuring comprehensive coverage.

Explore more details here →

Why Every Buyer in the USA, UK, Canada, and Australia Needs Comprehensive Fitness Studio Insurance

Fitness studio insurance isn’t just about protecting your business from potential financial loss; it’s also about building trust with clients and enhancing the studio’s reputation. In countries like the USA, UK, Canada, and Australia, having the right insurance policies is a critical component of demonstrating professionalism and responsibility. Clients are more likely to choose a fitness studio that has comprehensive insurance because it reassures them that they will not be held financially responsible in case of accidents or injuries.

In Tier One markets, the cost of legal claims and property damage can be substantial. A single lawsuit can cripple a small business, especially if the studio is found liable for an injury. Comprehensive insurance policies protect the studio against these types of financial burdens, enabling the business to focus on growth and long-term sustainability.

Key Tip: Ensure your fitness studio has the right insurance coverage to enhance client trust, reduce risk, and protect your business from unexpected costs.

General Liability Insurance for Fitness Studios: Enterprise Risk and ROI Protection

General liability insurance is one of the most important policies for any fitness studio. It provides coverage for a variety of risks, including bodily injury and property damage claims. For example, if a client injures themselves while using equipment or a trainer makes a mistake, this insurance covers the cost of medical bills, legal fees, and other expenses associated with the claim.

For fitness studios in Tier One markets, general liability insurance helps minimize the financial impact of accidents and legal disputes, allowing businesses to continue operating smoothly. Additionally, general liability insurance can be a selling point for clients who are concerned about their safety during workouts.

Professional Liability and Trust-Building Coverage for Fitness Studio Owners

Professional liability insurance protects fitness studio owners from lawsuits that arise due to mistakes or omissions in the services provided. For instance, a personal trainer might face a lawsuit if a client claims that a workout plan caused an injury. Professional liability coverage helps mitigate the financial risks associated with these claims, ensuring that the studio owner’s assets are protected.

Moreover, having professional liability insurance boosts trust among clients, showing that the fitness studio takes their safety and well-being seriously. In competitive markets like the USA, UK, and Australia, building trust with clients is key to long-term success, and professional liability coverage can be a crucial part of that.

Explore more details here →

Basic Fitness Studio Insurance Coverage That Boosts ROI and Buyer Confidence

For smaller fitness studios or those just starting out, basic insurance coverage that includes general liability and property insurance is an excellent starting point. This coverage protects the most common risks and can help save on premium costs compared to more extensive policies. By choosing a basic insurance plan that offers comprehensive coverage, studio owners can protect their business while also building client confidence in the studio’s reliability.

How to Compare Fitness Studio Insurance Quotes for Maximum ROI in USA & UK

When comparing insurance quotes for a fitness studio, it’s important to evaluate the policy’s coverage and cost against the studio’s unique needs. Start by assessing the potential risks specific to your location and the services you provide. For example, if you offer high-intensity training or have a large number of clients, you may need higher coverage for injuries.

Why Equipment Insurance Matters for Long-Term Growth in Canada and Australia

In Canada and Australia, fitness studios often invest in expensive gym equipment, such as treadmills, weights, and machines. Equipment insurance helps protect these assets from damage or theft, ensuring that the studio can continue operations without significant disruption. Without equipment insurance, the financial burden of replacing broken or stolen equipment could set back a studio’s growth.

Step-by-Step Guide: Choosing the Best Fitness Studio Insurance Policy for Enterprises

Choosing the best fitness studio insurance policy requires careful consideration of the business’s needs. Here’s a step-by-step guide to help fitness studio owners select the right coverage:

- Assess your Risks: Understand the specific risks your studio faces, such as client injuries or equipment damage.

- Research Providers: Look for insurance providers with experience in fitness and wellness industries.

- Compare Quotes: Get quotes from multiple insurers to compare coverage options and costs.

- Choose Comprehensive Coverage: Opt for policies that cover both general liability and professional liability.

- Review Annually: Insurance needs change over time, so it’s important to review your policies annually.

Table of Contents

Key Tip: Work with an insurance broker who specializes in fitness studios to help navigate the complexities of coverage options.

Case Study: How Fitness Studios in the USA Reduced Costs with Comprehensive Insurance Coverage

Fitness studios in the USA have significantly reduced operational costs by investing in comprehensive insurance policies. One example is a studio in California that bundled its general liability, property, and equipment insurance policies, saving over 20% on premiums. By consolidating policies with one provider, the studio reduced administrative costs and simplified the claims process.

Insurance Industry Insights: Fitness Studio Risk Management Best Practices in UK & Canada

In the UK and Canada, fitness studios are increasingly adopting a proactive approach to risk management. By regularly reviewing insurance policies and investing in preventative measures, such as employee training and equipment maintenance, studios are reducing the number of claims filed and lowering overall insurance costs.

Top Fitness Studio Insurance Trends in Australia: Growth, Cost Savings, and Buyer Trust

In Australia, fitness studios are seeing a shift towards more flexible insurance policies that cater to the unique needs of boutique gyms and fitness centers. By opting for modular insurance packages, studios can tailor their coverage to their specific needs, leading to cost savings and better protection for their assets.

Expert Report: ROI and Conversion Statistics from Fitness Studio Insurance Policies

Research shows that fitness studios that invest in comprehensive insurance coverage see a significant increase in ROI and customer conversions. A study conducted by an industry expert found that studios with general liability and professional liability insurance reported a 15% higher client retention rate and a 10% higher conversion rate than those without coverage.

Enterprise Insights: Fitness Studio Insurance Growth Across USA, UK, Canada & Australia

The fitness studio insurance market has experienced steady growth across Tier One countries. In the USA, insurance premiums have increased due to the growing number of claims related to personal injury. Meanwhile, in the UK and Canada, rising awareness of liability risks has led to an increase in the adoption of specialized fitness insurance policies.

Trusted Sources: Buyer Data on Fitness Studio Insurance Costs and Lead Generation

Buyer data from fitness studios across the USA, UK, Canada, and Australia shows that studios with comprehensive insurance policies tend to generate more leads and attract higher-quality clients. The investment in insurance demonstrates professionalism and enhances the studio’s reputation.

FAQs

- What is the best fitness studio insurance policy for ROI in the USA?

The best fitness studio insurance policy for ROI in the USA combines general liability, professional liability, and equipment insurance. This combination ensures comprehensive coverage while protecting the studio from common risks, reducing costs, and enhancing client trust. Investing in bundled policies can further maximize ROI by offering discounts and simplified claims processing. - How much does gym and fitness studio insurance cost in Canada vs USA?

The cost of fitness studio insurance varies depending on factors such as location, studio size, and coverage needs. On average, gym insurance in the USA tends to be higher due to the greater number of lawsuits and claims. In Canada, insurance premiums are generally lower, but studios should still expect to pay for comprehensive coverage based on their specific risks. - Which insurance services deliver the highest trust and conversions for fitness centers?

General liability and professional liability insurance are two of the most trusted policies for fitness centers. These cover personal injury claims and errors in professional services, such as personal training. Offering these policies not only protects the studio but also increases trust and confidence among clients, leading to higher conversions. - What is the top checklist for choosing fitness studio insurance in the UK?

The top checklist for choosing fitness studio insurance in the UK includes assessing risks, comparing multiple quotes, ensuring that the insurance covers all potential liabilities, and selecting providers with experience in the fitness industry. Additionally, consider bundling insurance policies for savings. - Why do enterprises and decision-makers invest in fitness studio liability insurance?

Enterprises and decision-makers invest in fitness studio liability insurance to protect their businesses from potential financial losses due to accidents or legal claims. Liability insurance offers peace of mind and safeguards the business from high legal costs and compensation payouts. - Which companies offer the best ROI-focused fitness studio insurance in Australia?

In Australia, leading insurance providers such as AIG, Suncorp, and QBE offer ROI-focused fitness studio insurance. These providers offer customized policies that cater to the unique needs of fitness businesses, ensuring that studio owners get the best value for their money. - How do fitness studio owners reduce costs with bundled insurance policies?

Fitness studio owners can reduce costs by bundling different types of insurance policies, such as general liability, equipment, and property insurance, with one provider. This often results in lower premiums and simplified claims processing, which can save both time and money. - What are the top benefits of comprehensive fitness insurance for Tier One markets?

Comprehensive fitness insurance provides several benefits, including protection from a wide range of risks, enhanced client trust, and greater business stability. In Tier One markets, comprehensive coverage can help studios reduce costs, improve customer retention, and maximize ROI. - How to compare fitness studio insurance providers for lead generation and savings?

To compare fitness studio insurance providers, gather quotes from multiple insurers and assess the coverage, exclusions, and premiums. Consider providers who specialize in fitness insurance and offer tailored packages for your studio’s size and services. Comparing policies will ensure that you get the best value for your money. - Which fitness insurance jobs and services are most in demand in USA, UK, and Canada?

In the USA, UK, and Canada, fitness insurance jobs in underwriting, claims processing, and risk management are in high demand. Additionally, there is a growing need for insurance agents specializing in fitness studio policies to help businesses select the right coverage.